CTV ad spending is projected to surge past $25 billion in the U.S. alone in 2025, while social media platforms saw a plateau in ROI across key verticals.

For performance marketers, the warning signs are clear: rising costs, attribution loss, and ad fatigue are making it harder to scale.

Yet most marketers still default to social without questioning whether their dollars are delivering the same punch.

Of course, you can start thinking outside the box.

Shifting a portion of your budget allocation to Connected TV helps you reach high-value audience segments, increase brand lift across streaming screens, and tap smarter tools like first-party data and programmatic buying via platforms like The Trade Desk.

This article breaks down exactly when and how to start shifting ad budgets from social to CTV without losing momentum or performance.

P.S.: For deeper benchmarking and templates, explore our guide: Creative Testing & Measurement for Large Brands.

Social media offers unrivalled reach. According to DataReportal, there are over 5 billion users globally as of 2024, which means nearly two-thirds of the world is reachable via major social platforms.

With formats like short-form social videos and influencer marketing, it's ideal for performance marketing, especially in consumer-packaged goods and DTC.

Side note: Want to start an influencer campaign? We’ve analyzed the Top 15 Influencer Marketing Agencies Trusted by Fortune 500 in 2025.

But social is not without its challenges: average CPMs across paid socials rose 28% YoY in June 2024, as we shared earlier, reflecting mounting competition for attention. This drives up costs. At the same time, signal loss from privacy updates weakens attribution and MER stability, so it’s harder for marketers to justify rising costs.

Besides, ad fatigue is increasing; over-exposed audiences scroll past digital formats fast, making frequent creative refreshes essential.

Insider tip: Rotate your influencer-led social videos every 4–6 weeks and measure engagement decay via your media agency’s dashboard to stay ahead of creative burnout.

As a performance marketer, you need to understand how Connected TV (CTV) diverges from traditional linear TV and why it's becoming instrumental in many media strategies.

CTV, delivered via Smart TVs, gaming consoles, or devices such as Amazon Fire TV, enables ad-supported streaming across apps like Pluto TV and Peacock TV, offering addressable impressions and richer audience segments.

According to MNTN research, U.S. Connected TV (CTV) ad spend is expected to hit US$33.35 billion in 2025, which shows us it works.

After all, compared to linear TV, CTV gives you access to household-level data, interactive ad formats (including shoppable ads), and improved completion metrics for streaming screens. Those are all good reasons to invest in it.

Side note: Looking for expert partners? Check out Top 15 Connected TV (CTV) Advertising Agencies Powering Enterprise Brands in 2025.

Now, we’ll pinpoint when to redirect a portion of your social media budget into Connected TV, evaluating budget allocation, ad fatigue, and emerging audience segments.

Shifting social media spend into CTV delivers incremental reach.

The Trade Desk found 99.5% of CTV audiences were not reached via linear TV. And with 88% of U.S. households owning a CTV device, marketers can access untapped audience segments. CTV campaigns consistently report 90%+ video completion rates, driving measurable brand lift.

In fact, swimwear brand Cupshe’s CTV ads resulted in viewers being 3.4x more likely to visit checkout pages than non-exposed users.

Insider tip: Carve out “new-to-brand” audience segments for CTV buys to ensure incremental reach vs. social overlaps.

CTV offers deeper engagement via interactive ads on smart TV interfaces and streaming screens.

This is supported by reports of completion rates of 96.4% for interactive CTV vs. 84% for standard video.

Similarly, VDO.AI found CTV completion rates of 91% across 200+ campaigns.

Insider tip: Convert your top-performing social videos into 15-second CTV versions with clickable overlays to extend engagement.

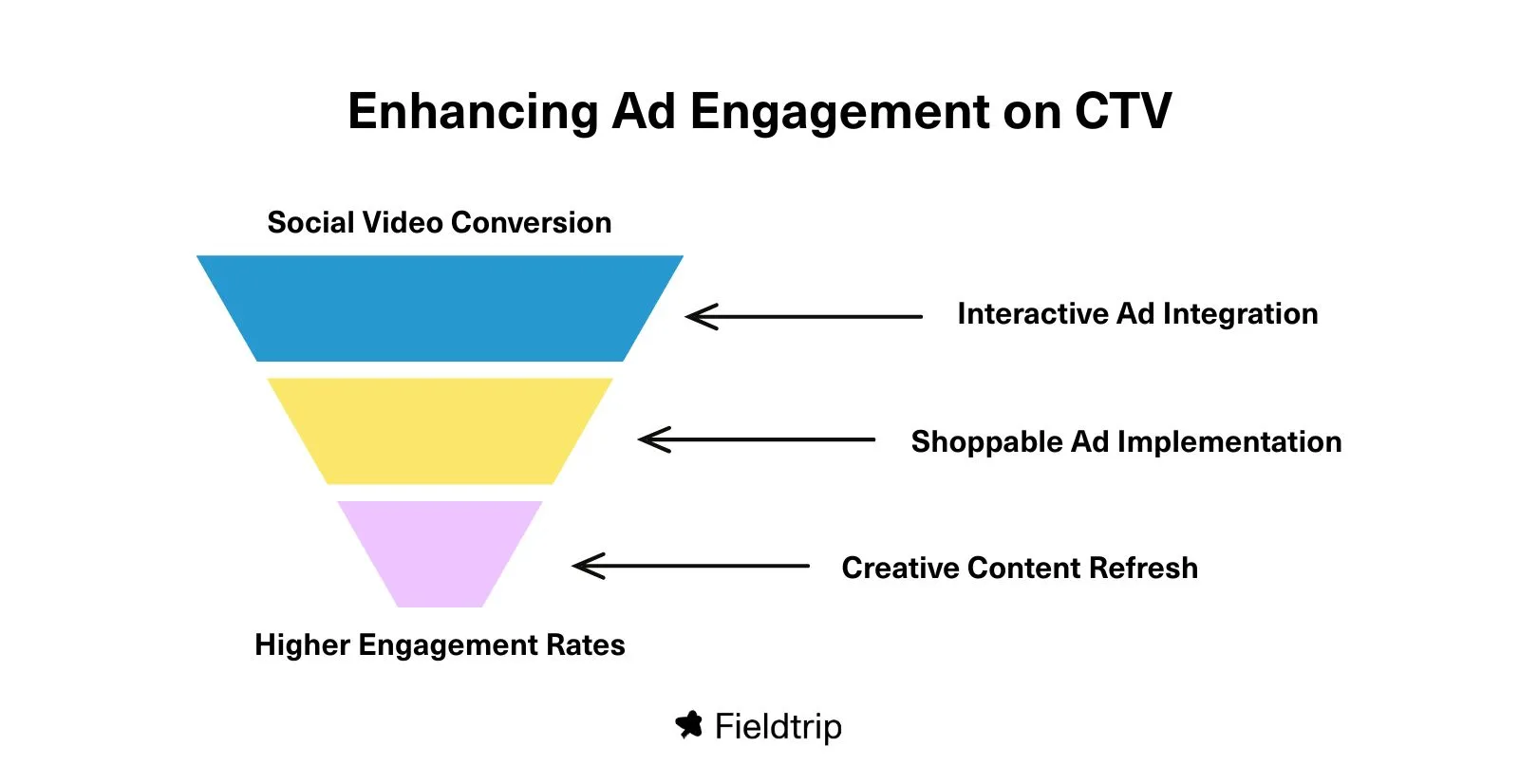

If higher engagement rates are what you’re after, you’ll find that formats like interactive shoppable ads increase ad engagement and refresh creative content.

With privacy laws tightening, attribution accuracy is crucial.

That’s why we advise you to use platforms such as The Trade Desk and Google’s DSPs. They enable programmatic buying tied to household-level data, clean rooms, and probabilistic matching.

Insider tip: Run A/B tests comparing social-only vs. social + CTV cohorts using first-party data inside your clean room to measure incrementality and guide reallocation.

Deterministic + probabilistic CTV measurement is now standard. It blends verified identifiers (like device IDs or IPs) with modeled insights from behavioral signals.

The result is a privacy-safe, holistic view of how CTV ads drive engagement, conversions, and brand lift across streaming screens and social media.

Side note: For a deeper brakdown of attribution frameworks, visit Multi-Touch Attribution vs Marketing Mix Modeling: Pros, Cons, and When to Use Each.

Programmatic technology via DSPs like The Trade Desk enables first-party data activation to reach cord-cutters on FAST platforms.

88% of U.S. households now own a Connected TV (as we referenced earlier), so it’s no wonder that targeting at the household level has become so precise.

DTC and subscription brands typically use these capabilities to find underserved viewers and convert new households, cutting cost-per-conversion.

Insider tip: Map CRM purchase clusters, exclude high-frequency social users, and test new audience segments via CTV to scale efficiently.

Over 50% of consumers report ad fatigue on social media.

To combat ad fatigue and keep audiences engaged, shift your ad dollars from over-served social placements to fresh CTV environments.

In fact, many marketers are turning to Connected TV for fresher, more engaging formats.

Using modular production, brands can adapt creative across streaming screens with interactive ads, from shoppable spots to gamified storytelling. This way, they achieve 40% higher brand recall and 25% better frequency control.

Insider tip: Leverage cross-platform data to cap frequency and refresh creative every four weeks to avoid saturation.

CTV advertising’s closed ecosystems, unlike open web ad exchanges, significantly reduce exposure to ad fraud and ad blockers.

Yet, risks remain: Open CTV inventory saw 19.4% invalid traffic in Q2 2024, representing ~US $1.14 billion lost.

Insider tip: Demand SSP transparency and benchmark fraud rates quarterly with your DSP partner.

To mitigate against this risk, use supply-side platforms and programmatic tech supporting clean rooms, AI-led fraud detection, and privacy-safe multi-touch attribution.

Side note: You can also read Marketing Transformation for Fortune 500 Brands to explore how enterprises are adapting to privacy and fraud shifts.

Next, discover how you can integrate CTV advertising and social media, making them work for you.

Combining social platforms and Connected TV under a cross-channel video strategy lets you define unified objectives. These include improving brand health, driving search intent, and creating measurable organic and direct-traffic lift.

To support this, media agencies such as GroupM and Wavemaker are adopting integrated measurement systems that link social video performance with CTV exposure. That way, you can track brand lift and search lift within one connected dashboard.

Insider tip: Set cross-channel KPIs upfront and share dashboards with both social and CTV buys to avoid siloed budget allocation.

Make sure your KPIs span video completion rates, brand recall, and direct response, to balance upper-funnel reach with performance.

You can leverage data for smart targeting and activation by doing the following:

In short: Pair broad social reach with CTV advertising’s precision and storytelling depth. That mix improves both short-term conversions and long-term brand health.

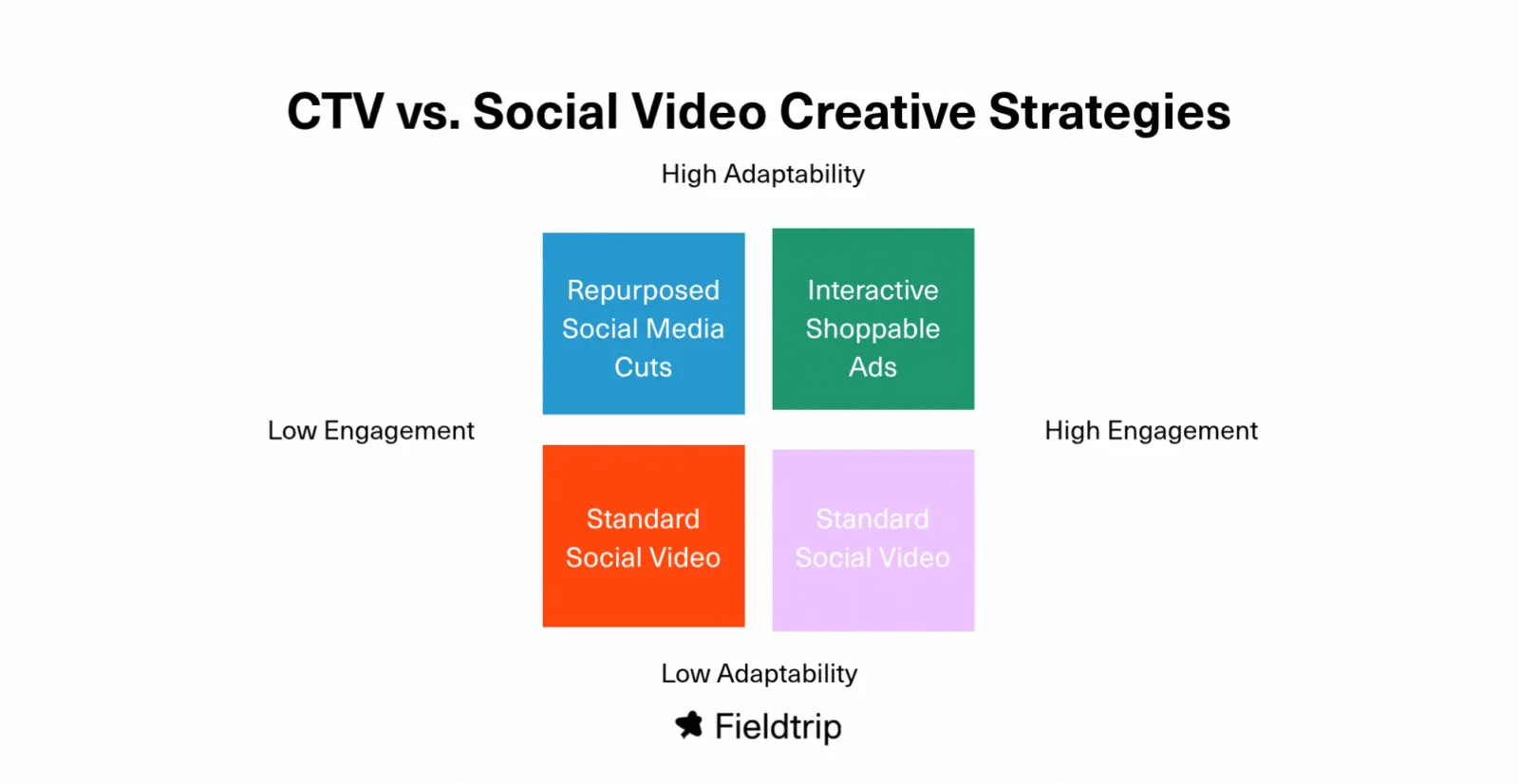

Creatives designed for social videos rarely perform optimally on smart TV interfaces and streaming screens, as they’re not reformatted for the different display.

On CTV, formats like interactive shoppable ads or widescreen cuts drive stronger engagement: a study found CTV HomeScreen ads achieved a 48% attention rate, 16% higher than YouTube pre-roll.

In practice, brands can and do repurpose shorter social media cuts into longer widescreen CTV modules.

For that, we advise you to:

Programmatic platforms such as The Trade Desk and Google DV360 make CTV ad buying more efficient by automating bids and connecting advertisers directly to premium, transparent inventory. They also combine audience data with performance tracking, so every impression is measurable.

We advise you to use household-level data and privacy-safe clean rooms to link ad exposure to real outcomes (like conversions or brand lift) without compromising user privacy. In fact, clean-room studies increasingly show that CTV exposure improves brand recall and purchase intent compared with non-targeted TV buys.

To keep performance consistent, focus on a few best practices:

Continuous testing of creative, targeting, and placement is critical.

For example, run an A/B test where one cohort sees social-only placements and another sees social + CTV to measure incremental lift. Use your first-party data feedback loops to refine audience segments and update messages dynamically.

Insider tip: Adopt a 4-week sprint cycle: test, measure, learn, and iterate to stay agile in both social and CTV channels while keeping creative content modular and data-driven.

If you observe ad fatigue on social media, shift budget to CTV where fresh formats and streaming screens maintain interest.

Once your CTV and social activations are running in sync, the next step is long-term convergence.

Today’s most effective campaigns use both social and Connected TV as parts of a single ecosystem. Social provides precision and engagement; CTV advertising adds reach, storytelling, and higher attention. And according to Smartly, 78.4% of marketers already run both, proving that convergence is now standard practice.

The next step is integration powered by AI.

As AI-led tools advance, they’re improving creative versioning, predicting audience overlap, and optimizing spend between channels in real time.

Brands that build modular creative, shared data systems, and unified dashboards will lead this new era of converged video marketing, where reach and relevance finally work together.

Side note: Need help managing this convergence? We analyzed the Top Programmatic Advertising Agencies that can help you bring CTV and social together.

Brands reallocating social media spend to CTV advertising are seeing results, with an 8.6% lift in brand awareness. And with ad fatigue rising on static formats, it’s time to rethink your budget allocation.

A balanced strategy across social platforms and Streaming TV (including FAST channels like Pluto TV and Amazon Fire TV) lets you adapt creative content and measure impact across streaming screens.

This, combined with using A/B tests and first-party data, helps you dial in performance.

Want to reap the results?

Partner with Fieldtrip to design your converged TV + social strategy.

1. How does Connected TV advertising differ from other streaming video channels?

Connected TV (CTV) runs on large-screen streaming apps like Hulu, Netflix Ads, or YouTube TV, reaching logged-in households rather than individual feeds. It combines high-attention viewing with precise audience segmentation and advanced measurement capabilities, so it’s a powerful performance channel as well as a brand-building medium.

2. What interactive or shoppable elements work best on CTV?

Brands are adding interactive elements such as clickable formats, QR codes, and shoppable elements that drive direct response without disrupting viewing. Platforms like Samsung Ads and other ad-supported platforms now enable on-screen engagement and track follow-up actions.

3. How should we adapt creative assets for different screens?

Use modular formats so the same shoot can produce vertical social edits and widescreen CTV versions. Keep text minimal for TV and prioritize storytelling over speed. This approach allows DSP-agnostic execution across multiple buying platforms while maintaining consistent brand voice and brand safety.

4. What’s the best way to measure campaign impact across CTV and social?

Start with a unified measurement plan that combines attribution models, brand-lift surveys, and geo holdouts to isolate incremental impact. Compare success metrics such as view-through rate, brand recall, and downstream conversion within one dashboard to understand how each channel contributes to the customer journey.

5. How is media consumption shifting toward CTV?

Audiences are spending more time on streaming video via ad-supported platforms, giving CTV a growing market share of total screen time. As viewers move from linear TV to streaming apps, advertisers gain new targeting capabilities and more transparent measurement options. This way, CTV complements other data-driven channels like paid social and email marketing really well.